If you are a Dallas homeowner struggling to make mortgage payments, you may be considering whether selling your house to avoid foreclosure is your best option.

We all know Texas is the best state.

But in the foreclosure context, it is one of the least protective states for borrowers’ rights.

My name is Scott, and I am a real estate professional with a decade of experience in the Dallas market.

I have a great deal of specific experience dealing with foreclosures in Dallas County.

This article will outline the foreclosure process and provide some solutions to the problem, including whether selling your house to an investor is the best option to avoid foreclosure.

Foreclosure is a legal process that allows the lender to take back your property and sell it to recover the money you owe.

Fortunately, there are ways to avoid foreclosure. In this blog post, we will explain how foreclosure works in Texas, the impact foreclosure can have on borrowers, what options you have to prevent it, and why selling your house to avoid foreclosure may be one of the best solutions.

How Foreclosure Works in Texas

There are two types of foreclosure in Texas, (1) judicial foreclosures and (2) nonjudicial foreclosure, which are defined in the Texas Property Code, Chapter 51.

Of these two types of foreclosure, nonjudicial foreclosure is the one encountered far more frequently.

Non-judicial foreclosure allows for the lender to avoid the court system and force the sale of your home at a public auction.

Since non-judicial foreclosure takes a lot less time and money for a lender to execute, this is the ideal method for a lender to pursue. All the lender has to do is include a “power of sale” clause in your loan documents, and that allows the lender to use the nonjudicial process in Texas.

So let’s take a closer look a the non-judicial foreclosure process, since this is one you’re far more likely to encounter.

Nonjudicial Foreclosure

The foreclosure process in Texas from start to finish can take as little as 41 days.

This is from the first missed payment to the sale of the home at auction.

Here is a little background on how this process works in Texas and how it is different than other states.

Title Theory vs. Lien Theory

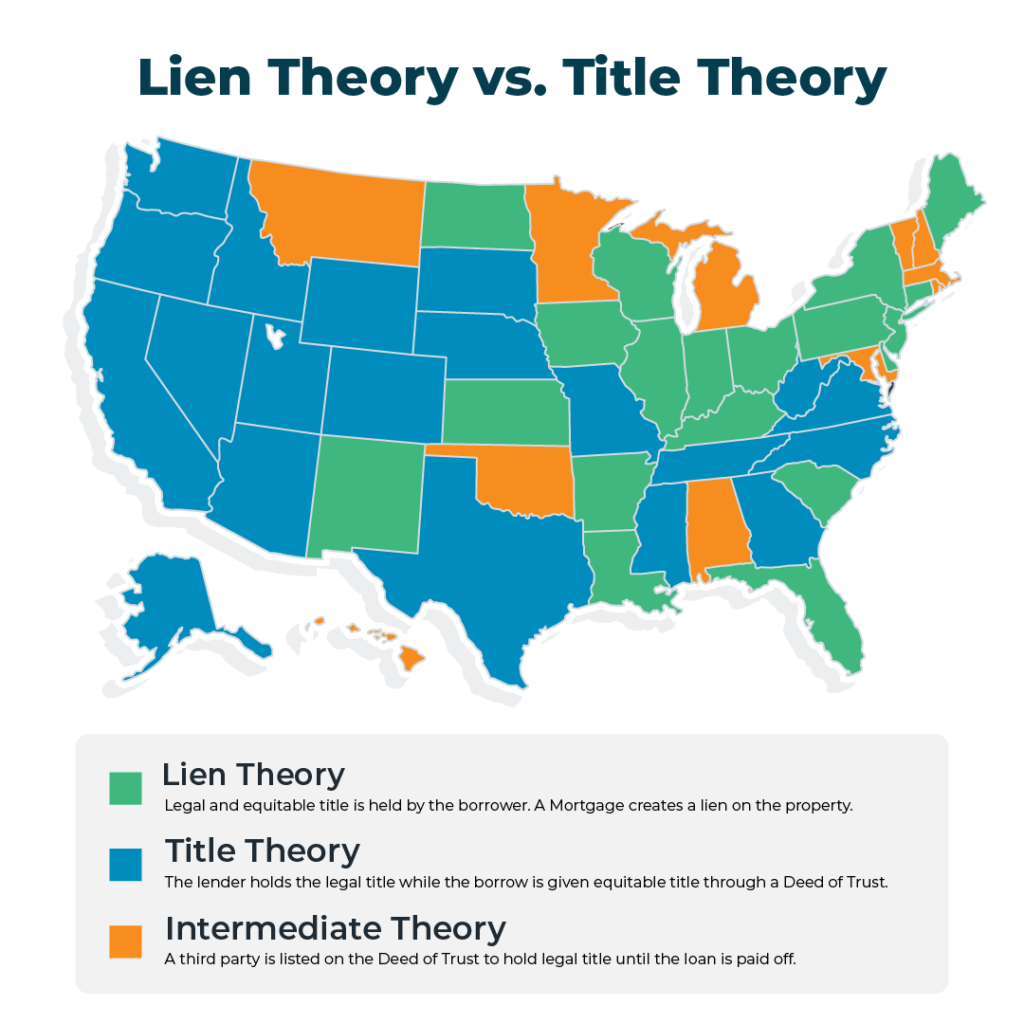

There are two legal theories that apply to different state in the US, “title theory” and “lien theory”.

Lenders in “title theory” states use a “deed of trust” to secure their loan in real estate, which involve three parties: the borrower (trustor), the lender (beneficiary), and a third-party trustee who holds the legal title of the property until the loan is repaid. Texas is a title theory state.

Lenders in “lien theory” states use “mortgages”, which involve two parties: the borrower and the lender. The borrower holds the legal title of the property and the lender has a lien on it until loan repayment.

If you’ve heard the term “mortgage” thrown around in Texas, this is just a colloquialism.

There are technically no mortgages in Texas, lenders use Deeds of Trust in Texas.

Why does this matter?

One of the main implications of this difference is how foreclosure works in each type of state.

In a Title Theory/Deed of Trust state (like Texas), the trustee can initiate a nonjudicial foreclosure, which means they can sell the property without going through the court system.

This process is usually faster and cheaper than a judicial foreclosure, which is required in mortgage states. In judicial foreclosure, the lender has to file a lawsuit against the borrower and obtain a court order to sell the property.

Step for Nonjudicial Foreclosure

If the borrower fails to make all loan payments, then the borrower is in “default” of the Deed of Trust.

If the borrower is in default, then the lender can begin foreclosure proceedings.

Here are the lender’s next steps toward foreclosure, which are governed by Section 51.002 of the Texas Property Code:

- Notice of Default – Lender gives the borrower a Notice of Default, indicating that borrower is in default of the loan and has 20 days to cure the default (this is the “right to reinstate”). If the borrower can cure the default, then the process stops here.

- Notice of Sale (also “Notice of Trustee’s Sale” or “Notice of Substitute Trustee’s Sale”) – Lender gives the borrower notice at least 21 days in advance that the lender plans to sell the property at a public auction. This notice must also be posted on the “courthouse door” (i.e. the bulletin board at the courthouse) and filed with the county clerk.

- Conduct the sale – Finally, if the borrower fails to cure the default, the trustee (or substitute trustee) will conduct the sale in the area designated for public sales at the county courthouse at the time stated in the Notice of Sale (which must be between 10 AM and 4 PM) on the first Tuesday of the month.

On the sale date, your property can be sold to the highest bidder at the public auction. The bidder must pay cash or a cashier’s check at the time of the sale. If no one buys the property, the lender will own the property.

Impact of Foreclosure

Foreclosure can have serious consequences for the borrower that are both financial and emotional.

Here are some of the reasons why a borrower would want to avoid foreclosure in Texas:

- Credit score damage: In terms of destructive impact, foreclosure is like the atomic bomb for your credit rating.

- Within 3 to 6 months of the lender initiating the foreclosure proceedings, the foreclosure will appear on your credit score. Additionally, the lender will report any missed or delinquent payments that led up to the foreclosure. This combination can be disastrous for your credit score. A foreclosure stays on your credit report for 7 years.

- Here’s a brief summary of how much a foreclosure will hurt your credit score from FICO:

- 30 days late: 40 to 110 points

- 90 days late: 70 to 135 points

- Foreclosure, short sale or deed-in-lieu: 85 to 160

- Bankruptcy: 130 to 240

- Emotional stress: Foreclosure is an extremely emotional process, creating enormous stress for the borrower and their family. Facing foreclosure is a traumatic experience that affects one’s sense of security, stability, self-esteem and confidence.

- Deficiency judgement: Even after foreclosure, the lender can come after you for more money! If the lender can’t sell your house at auction for more than what you owed to the lender, then they can sue you within 2 years of the sale and demand payment for what they are still owed.

- Tax liabilities: In some cases, foreclosure can result in tax liabilities for the borrower. This happens when the lender forgives or cancels part of the debt that the borrower owes after selling the foreclosed property. The forgiven or canceled debt is considered as income by the IRS and may be subject to income tax.

- Home equity loss: When a house is foreclosed on, the borrower loses all equity (difference between home’s market value and what is owed on the loan) he/she might have built up in their home over the years.

What Options Do You Have to Avoid Foreclosure?

Now that you have an overview of the legal process, let’s talk about how this situation can be avoided.

If you are facing foreclosure, you should not ignore the problem or hope that it will go away. The sooner you take action, the more options you will have. Here are some of the options you can consider:

Communicate with Lender

The first thing you should do is contact your lender and explain your situation. Your lender may be willing to work with you and offer you some alternatives to foreclosure, such as:

- A forbearance: This is an agreement that allows you to temporarily stop or reduce your payments for a period of time until you can resume making full payments.

- A loan modification: This is an agreement that changes the terms of your loan to try to help you catch up on the accrued balance of your loan.

Sell my house to avoid foreclosure

Here are a few ways that could happen:

- If you have equity in the house (i.e. the house is worth more than what you owe on the loan), then you can sell the house for cash and walk away

- If you owe more on the loan than your house is worth, the lender might allow a short sale. This is an agreement that allows you to sell your property for less than what you owe the lender.

Deed in Lieu

If you’ve decided to give up the property for no money, the lender might allow a deed in lieu. This deed in lieu of foreclosure lets you hand over title to the lender prior to the foreclosure sale. Since you are paid nothing for this, a deed in lieu should be an absolute last resort. The only advantage is that you avoid the additional credit hit of having an actual foreclosure on your credit history.

File for Bankruptcy

Filing for bankruptcy is a way to avoid foreclosure, but has serious legal and financial consequences of its own. Consulting an attorney is critical to evaluate whether bankruptcy is a viable option for you and whether it would be likely to help avoid a foreclosure.

Why Selling Your House May Be Your Best Option to Avoid Foreclosure

Selling your home is the cleanest and quickest way to avoid foreclosure.

It can also minimize the impact that the foreclosure process will have on your credit score.

Some of the alternatives like bankruptcy, short sales, and deeds in lieu have virtually the same impact on your credit score as allowing the foreclosure to take place.

But home-selling with the traditional method (using MLS) can take up to 101 days!

Obviously you don’t have that kind of time.

That is why getting a quick, all-cash offer from someone like us is worth your time.

We can operate quickly to close on your house before the foreclosure auction.

Here’s why you might be interested in our company?

- We’re a family-run, local company that buys homes in Dallas

- We’ll make you a fair offer within 24 hours

- We can close deals quickly to help you avoid foreclosure

- You won’t have to worry about repairs, commissions, fees, or any other hassles

If you are interested in selling your house to avoid foreclosure, please contact us today. We will evaluate your situation and make you a no-obligation cash offer that meets your needs and goals. We are here to help you avoid foreclosure and move on with your life.